Retirement savings are a crucial aspect of financial planning, providing individuals with the financial security they need in their golden years. However, the question of “What’s the average retirement savings by age?” is an important one that requires careful consideration.

Understanding the importance of retirement savings

Retirement savings play a vital role in ensuring a comfortable and secure future. It allows individuals to maintain their standard of living, cover medical expenses, and pursue their passions. Without adequate savings, retirees may face financial hardships and have to rely on others or government assistance.

It’s essential to recognize that retirement savings aren’t just a luxury; they are a necessity. By setting aside funds throughout their working years, individuals can build a strong financial foundation for their retirement.

One of the key benefits of retirement savings is the ability to have financial independence during retirement. With sufficient savings, individuals can have the freedom to make choices without worrying about financial constraints. They can pursue hobbies, travel, or even start a new business venture without the stress of financial instability.

Additionally, retirement savings provide a safety net for unexpected expenses or emergencies that may arise during retirement. Having a cushion of savings can help individuals navigate through unforeseen circumstances such as medical emergencies or home repairs without having to rely on credit or deplete their retirement funds.

Why age matters when it comes to retirement savings

The age at which individuals start their retirement savings journey has a significant impact on the overall amount they can accumulate. The power of compound interest and investment returns means that starting early provides a substantial advantage.

Young adults in their 20s and 30s have the advantage of time on their side. By leveraging compounding interest, even small regular contributions can grow significantly over several decades. Conversely, those who delay saving until later in life face a more considerable challenge to catch up and meet their retirement goals.

Another factor to consider when it comes to retirement savings is the potential for increased healthcare costs as individuals age. As people get older, they may experience more health issues and require additional medical care. This can put a strain on their finances, especially if they haven’t saved enough for retirement. Starting to save early can help individuals build a larger nest egg to cover these potential healthcare expenses.

In addition, the age at which individuals plan to retire can also impact their retirement savings strategy. If someone plans to retire early, they may need to save more aggressively to ensure they have enough funds to last throughout their retirement years. On the other hand, if someone plans to work longer, they may have more time to save and potentially delay accessing their retirement savings, allowing it to continue growing.

The impact of starting early on retirement savings

Starting early in retirement savings can yield remarkable results. Let’s consider an example:

Suppose two individuals, John and Sarah, both decide to save for retirement. John starts investing $200 per month at the age of 25 and continues until he reaches 65, while Sarah starts at 35 with the same monthly contribution and retirement age. Assuming an annual return of 7%, John will have approximately $729,000 saved by the time he retires, whereas Sarah will only have around $324,000.

This example highlights the significant difference that a ten-year head start can make in retirement savings. The power of starting early cannot be overstated.

Not only does starting early in retirement savings allow for a longer period of time to accumulate wealth, but it also takes advantage of the power of compounding interest. Compounding interest is the concept of earning interest on both the initial investment and the accumulated interest over time. By starting early, John benefits from compounding interest for a longer duration, resulting in a much larger retirement savings compared to Sarah.

Breaking down the average retirement savings by age groups

When analyzing retirement savings by age groups, it’s crucial to understand that there is no one-size-fits-all approach. Various factors influence how much individuals save, including income, expenses, lifestyle choices, and access to retirement plans.

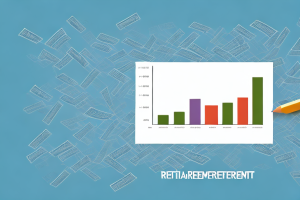

According to a recent study, the average retirement savings by age are as follows:

- 20s: The average retirement savings for individuals in their 20s is generally low, ranging from $10,000 to $35,000. This age group typically faces competing financial priorities and may not have substantial disposable income.

- 30s: By their 30s, individuals tend to have accumulated more assets, with average retirement savings falling within the $35,000 to $100,000 range. Increased income and a greater focus on long-term financial planning contribute to this growth.

- 40s: The average retirement savings for individuals in their 40s range from $100,000 to $200,000. At this age, people often have established careers but may still face expenses related to raising a family and homeownership.

- 50s: Individuals in their 50s generally have retirement savings ranging from $200,000 to $400,000. This age group begins to prioritize retirement planning and may have more disposable income as children become financially independent.

- 60s: As individuals approach retirement age, their average savings typically fall within the $400,000 to $600,000 range. At this stage, individuals become more conservative with their investments, focusing on preserving the wealth they have accumulated.

It’s important to remember that these figures represent averages and can vary significantly depending on individual circumstances. Factors such as income, location, and lifestyle choices all impact retirement savings.

However, it’s worth noting that these average retirement savings figures may not be sufficient for everyone’s retirement needs. The amount needed for a comfortable retirement varies depending on factors such as desired lifestyle, healthcare costs, and inflation. It’s essential for individuals to assess their own financial situation and consult with a financial advisor to determine the appropriate savings goal for their retirement.